The 2018 Supreme Court decision to strike down the Professional and Amateur Sports Protection Act (PASPA) greenlit the expansion of legalized sports wagering in the United States.

Before the decision, Nevada was the only state in America where wagering on single-game sports was legal. In 30 months following the decision (June 2018 – October 2020), legalized sports wagering has expanded to 18 states, plus the District of Columbia. More than $27 billion was legally wagered. $1.9 billion was generated in revenue, and $257 million was paid in taxes.1

By 2025 as many as 36 states will legally host sports wagering. More importantly, these states are expected to produce $7 billion a year in taxable revenue.2

Two External Factors Are Driving The Expansion

Beyond the repeal of PASPA, two external factors are driving the expansion of legalized sports betting. First, pandemic-related self-isolation is driving people onto the internet and this fuels digital sports wagering. Today more than 65% of legal betting is digital. By 2030, 90% of sports betting will be online.3

Next, the second factor involves the national debt. Earlier this year the federal government borrowed $2.7 trillion to mitigate the impact of Covid-19. As a result, the nation’s debt increased to $27 trillion which exceeds the size of the US economy.

Ironically, federal lawmakers created an economic imbalance that has not happened in America since World War II.4 In addition, they sent state legislators scrambling for new sources of revenue. Why? Because the states will receive less money from the federal government, but their budgets are legally required to balance (in more than 40 states).

Now state politicians are faced with a difficult choice. They can raise personal taxes, increase taxes on existing businesses, or they can enable new businesses and tax their revenues. Either way, lawmakers at the state level will have to find more money to balance their budgets, because of reduced federal subsidies caused by expanding the national debt.

Bookmaking Is A Competitive, Thin Margin Business

Sportsbooks retain approximately 5% – 7% of the money wagered. Add employee compensation, marketing, operating expenses, compliance, and taxes, and legal operators work under the pressure of razor-thin margins.

Legal operators also face intense competition from unregulated competitors. Illegal bookmaking has been going on in America for more than 100 years (Black Sox Scandal 1919). Furthermore, unregulated bookmakers have deep, sometimes generational relationships, with their customers. They do not require deposits. They can forgive debt without oversight and they do not pay taxes. Dislodging players from their unregulated bookmakers will not be a simple matter for legalized operators.

Efficient Digital Customer Acquisition Is Essential

Average player revenues range from $500-$700 annually. Player acquisition expenses can run as high as 40% of the first-year revenues. Therefore, efficient customer acquisition (to increase response rates and reduce costs) is essential to the overall profitability of a legal operation.

Unquestionably, online sports wagering is more profitable than an offline business. Digital players make larger wagers, and they are more cost-effective to service, but they are not as attracted to traditional off-line acquisition methods. Tactics like single-channel direct mail programs, offline list rentals, unfiltered email blasts, and in-person (rooms, food, and beverage) complementaries do not always align with the behavior of self-isolating, digital players who are internet savvy, younger, and well-versed in social media.

What Is An Identity Graph And How Does It Support Profitable Growth?

An identity graph is a uniquely architected data warehouse containing all known identifiers corresponding to individual consumers. Identity graphs contain privacy-compliant personal, demographic, and consumptive information describing individuals in a database. This includes behavioral data (i.e. gaming dispositions) age ranges, incomes, postal addresses, email addresses, mobile address IDs, IP addresses, and social handles – all deterministically matched to the individual’s resident in the data warehouse.

At Audience Acuity, our Super Identity Graph contains over 500 variables (7 billion data points) describing 234 million American adults. We can match a small sample of a bookmakers’ player attributes to our graph. (It should be noted, player names are not necessary to implement our matching process.) Then, we score the sample attributes against our database. We return a custom audience of prospective players that can be used to pinpoint omnichannel acquisition initiatives.

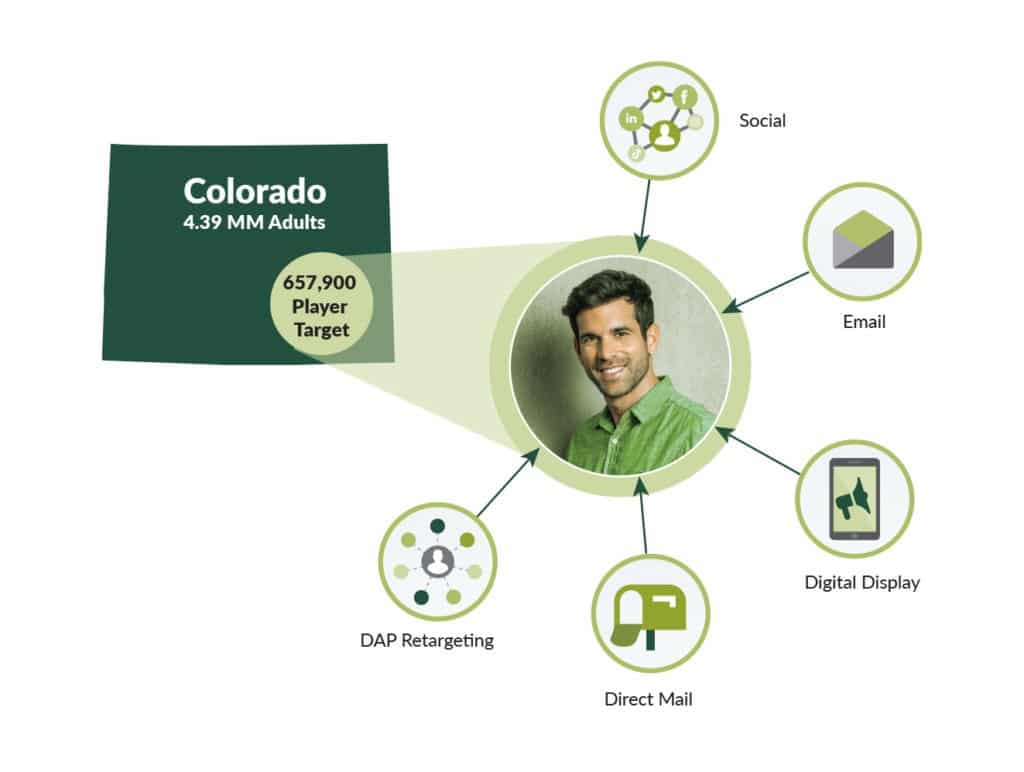

Here is an illustration:

In 2019 the State of Colorado approved sports wagering. 4.5 million people live there. Our identity graph contains detailed insight into the behavior of 4.39 million adults.

We modeled the behavior of known sports players against our database to determine the attributes of prospective players living in Colorado. This custom audience identified 657,900 men, over 21 with a known interest in gambling.

Legal bookmakers in Colorado can use this audience to micro-target social, email, and digital display advertising. They can also integrate over-the-top television, tactical direct mail, and digital audience profiling to tightly focus their marketing outreach.

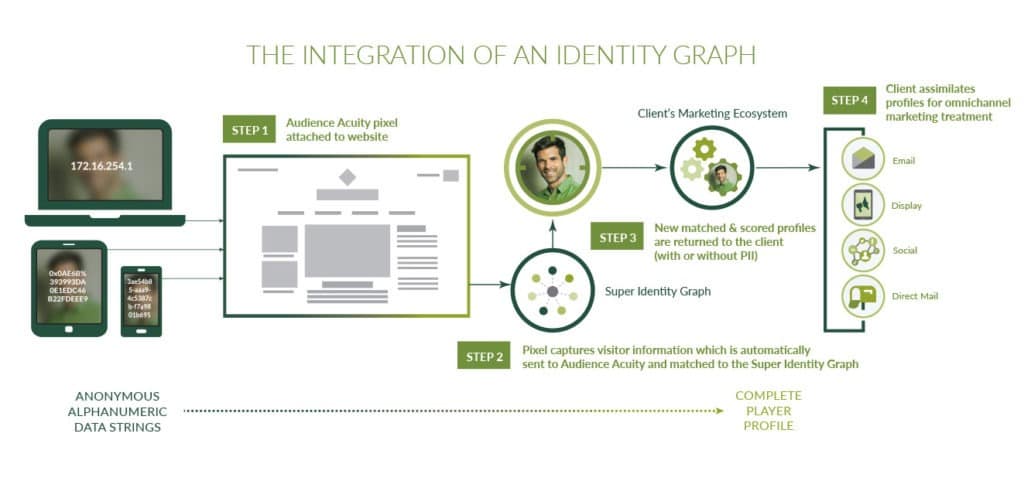

Digital audience profiling is particularly effective because it enables bookmakers to identify their unauthenticated digital traffic. This is accomplished by attaching our tracking pixel to their websites. Our tracking pixel captures the digital device ID’s from the incoming web traffic. Then, we match the device IDs to our identity graph where we authenticate the individuals’ identities. The newly authenticated visitors are modeled and scored for the appropriate marketing treatment.

Pairing custom audiences with digital audience profiling has the power to significantly improve player acquisition rates while materially reducing costs. Why? Because omnichannel prospecting to known micro-segments in near real-time has been proven to cost-effectively enhance consumer acquisition.

In the end, cost-effective acquisition impacts the financial performance of thin-margin consumer businesses. Effective leaders are always on the hunt to drive operating efficiencies as the industry expands and as their players move online. Identity graphs can help.

If you’re interested in learning more email riad.shalaby@audienceacuity.com

Notes:

1 https://www.legalsportsbetting.com/news/sports-betting-predicted-to-be-a-7-billion-industry-by-2025/

Want to Improve Your Activation Strategy?

Want to Improve Your Activation Strategy?