Improve Digital Engagement And Increase Operating Income

Today’s sophisticated QSR and fast-casual loyalty programs are rooted in the legendary S&H Green Stamp program launched in the 1930s. Nearly 100 years ago The Sperry & Hutchinson Company provided customers with stamps when they purchased merchandise. The stamps were redeemed for discounts and future purchases. The program was so successful that 80% of American households participated. As a result, the S&H catalog was the largest publication in the country.1

In the second half of the 20th Century, loyalty card initiatives replaced Green Stamps with automation and points. These programs expanded beyond retail and into the hospitality, travel, and restaurant industries. Automated restaurant rewards initiatives shared similar goals with their predecessors – to attract new customers, drive repeat consumption and build customer loyalty.

Over the past decade, card programs have evolved into sophisticated digital applications that integrate real-time data and mobile technology. These applications have become vital to QSR and fast-casual restaurants. They support consumer behavior in an era where time savings and off-premises conveniences are significant determinants of customer loyalty.

In 2017, 60% of QSR customers used only their mobile devices to help make their dining decisions, and 83% picked a dining location within three hours of a meal.2 Today digitized loyalty programs are essential. Customers demand expedient takeout, delivery services, and seamless digital integration to connect their mobile devices to their restaurant experiences.

According to a 2019 study conducted by Deloitte, the Covid-19 pandemic accelerated the industry’s investment in technology. Their research found 70% of the respondents demanded frictionless digital experiences and preferred virtual experiences to in-person dining. This required operators to align their restaurants to rapidly evolving market conditions.

Digital Loyalty Is The New Frontier

The in-person experience and the tools the restaurant industry has relied on for generations will carry QSR and fast-casual establishments only so far. To answer the demand for convenience today innovation is a necessity. To win the battles for repeat consumption and market share, digital loyalty is the new frontier. Where time sensitivity and frictionless virtual interactions are crucial to a brand’s success.3

Starbucks Rewards is considered by many to be the gold standard in the QSR loyalty category. In 2011 Starbucks launched its mobile app to enable mobile payments. In 2014, Starbucks introduced Starbucks Mobile Order & Pay. These apps conditioned millions of people to lock into their purchases ahead of time. By 2019, the majority of members using the app did so to order before they arrived in the store. Moreover, 71% of their app users visited a store at least weekly and were 5.6 times more likely to visit a Starbucks daily.4 Today Starbucks loyalty program has surpassed 20 million members.

Panera’s loyalty program is reported to have 40 million members. These customers are more likely to order online, drive-through, and use the brand 6 – 10 times more than non-members. Importantly, data from the program also provides management with insight that is especially useful now – where certain in-store operations have been shuttered or greatly restricted due to the pandemic.5

Recently loyalty programs have emerged as a major topic of conversation on earnings calls. Large companies from Wendy’s, Chipotle, and Taco Bell to Dunkin and Starbucks have enhanced their programs to keep dedicated customers engaged with their brands.

That said, effective digital loyalty in the QSR and fast-casual spaces is not the exclusive domain of the largest operators. Point of sale providers like Square, PayPal, and Sum Up, along with delivery services like Door Dash and Grub Hub, mature web developers, and self-service consumer data platforms (CDP) provide the cost-effective infrastructure enabling small operators to compete in the markets they serve.

Identity Graphs Empower Digital Loyalty And Drive Customer Engagement

Today enlightened leaders value timely consumer insight to inform operational execution and adjust to new service standards that underpin customer engagement.

In 2021 timely customer insight is based on a 360-degree view of the consumers’ interactions. That is, before, during, and after they consume their meals. A 360-degree view combines the transactional data found in the restaurants’ operating systems with online and offline information, demographics, and consumptive characteristics not contained in the transactional systems.

Consumer insights not contained in the operational data are provided by an identity graph. An identity graph is a third-party data source containing all the descriptive insights and consumer touch-points not available in the restaurants’ transactional files. The graph’s data includes digital activity, demographics and economic insights, geographic details like postal addresses and privacy safe encrypted email addresses, mobile address ID’s, IP addresses,. . . all (deterministically) linkable to the customers’ transactional file.

Restaurants incorporate 360-degree insight into loyalty applications ranging from new product development and activation to synchronized omnichannel communications. The aggregated data often resides in a customer data platform (CDP). A CDP is a marketing system that unifies a restaurant’s customer data from all channels and devices to enable analysis, modeling, micro-targeting, and attribution.6 Today restauranteurs can take advantage of mature, cost-effective CDP technology – including tools ranging from open-source engines (i.e., Data Lake) to fully configurable cloud-based solutions (i.e., Redpoint, Adobe, Oracle, and Microsoft.)

Identity Resolution Drives Loyalty & Optimizes Marketing Performance

Today, digital migration continues unabated in America. In fact, evidence suggests the pandemic materially increased the consumers’ use of digital technology in their restaurant ordering and dining experiences. (70% of QSR customers insist on frictionless digital experiences and they prefer virtual experiences to in-person dining. 8)

Cellular technology now underpins most of the connections between consumers and the restaurants’ websites. Yet only a small percentage of website visitors are known to the operators. That said, resolving unknown website traffic can be a goldmine for restaurant loyalty programs. Especially now as 3rd party cookies are retiring over the next 12 months.

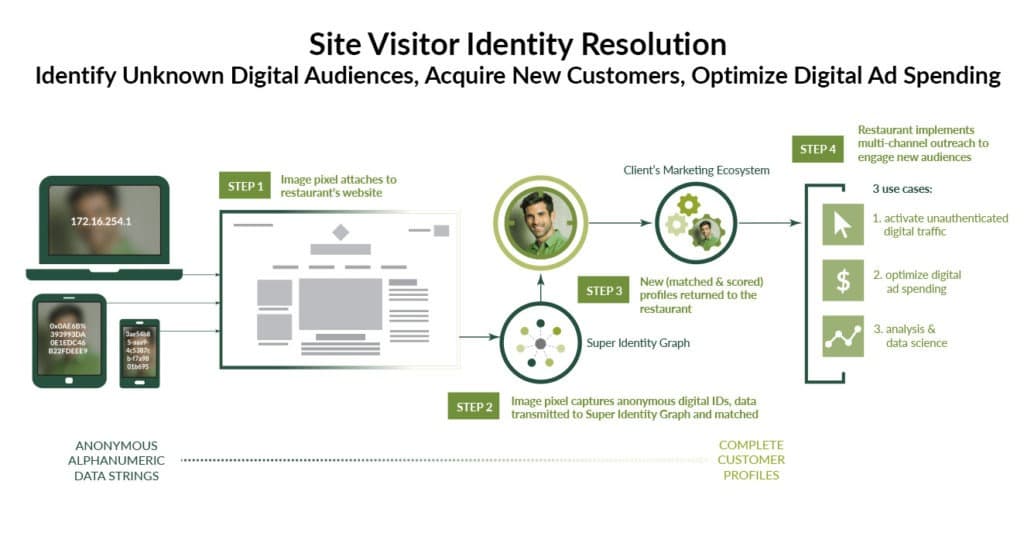

Operationally, site visitor resolution combines an identity graph with a first-party image pixel and an integrated customer data platform to identify unauthenticated web traffic. The diagram below illustrates the process that begins with capturing anonymous digital identifiers. The next step involves mapping the anonymous digital data to a graph. This is where the identities are resolved while the files are enriched with descriptive data used for omnichannel marketing applications.

Three popular marketing applications include audience activation, optimized cross-channel messaging, and attribution.

Personalized Experiences & Customer Journey Management

Today, QSR and fast-casual loyalty programs must engage consumers on a personal level, across devices – connecting their restaurant programs to customers’ devices. This requires privacy-compliant data that is contextually relevant, personalized, and shared across the enterprise to enable customer journey management.

Resolving consumer identities facilitates customer journey management and drives revenue by providing a 360-degree understanding of human behavior. This insight is discoverable by integrating identity-related data into QSR and fast-casual loyalty platforms.

Audience Acuity’s Identity Graph

Audience Acuity’s Super Identity Graph is one of the largest commercially available consumer data assets in America. Our identity graph contains over 2 billion mobile address IDs, hundreds of millions of email addresses, and 450+ attributes, both online and offline, all connected to 235 million Americans.

Identity Graphs Drive Digital Gaming Revenue

Identity Graphs Drive Digital Gaming Revenue